UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

SELECT BANCORP, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which the transaction applies: | |

| (2) | Aggregate number of securities to which the transaction applies: | |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of the transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

SELECT BANCORP, INC.

700 West Cumberland Street

Dunn, North Carolina 28334

(910) 892-7080

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

and

Notice of Internet Availability of Proxy Materials

To Be Held

May 16, 201719, 2020

NOTICE is hereby given that the Annual Meeting of Shareholders of Select Bancorp, Inc. (the “Corporation”) will be held as follows:

| Place: | Select Bank & | |

| Trust 700 West Cumberland Street Dunn, North Carolina | ||

| 28334 | ||

Date: Time: | May | |

| 19, 2020 10:00 a.m. |

The purposes of the meeting are:

| 1. | Election of Directors. To elect |

| 2. | Advisory Vote to Approve Named Executive Officer Compensation. To vote on a non-binding, advisory proposal to approve compensation paid to our named executive officers (commonly referred to as a “say-on-pay” vote); |

| 3. | Ratification of Accounting |

| Other |

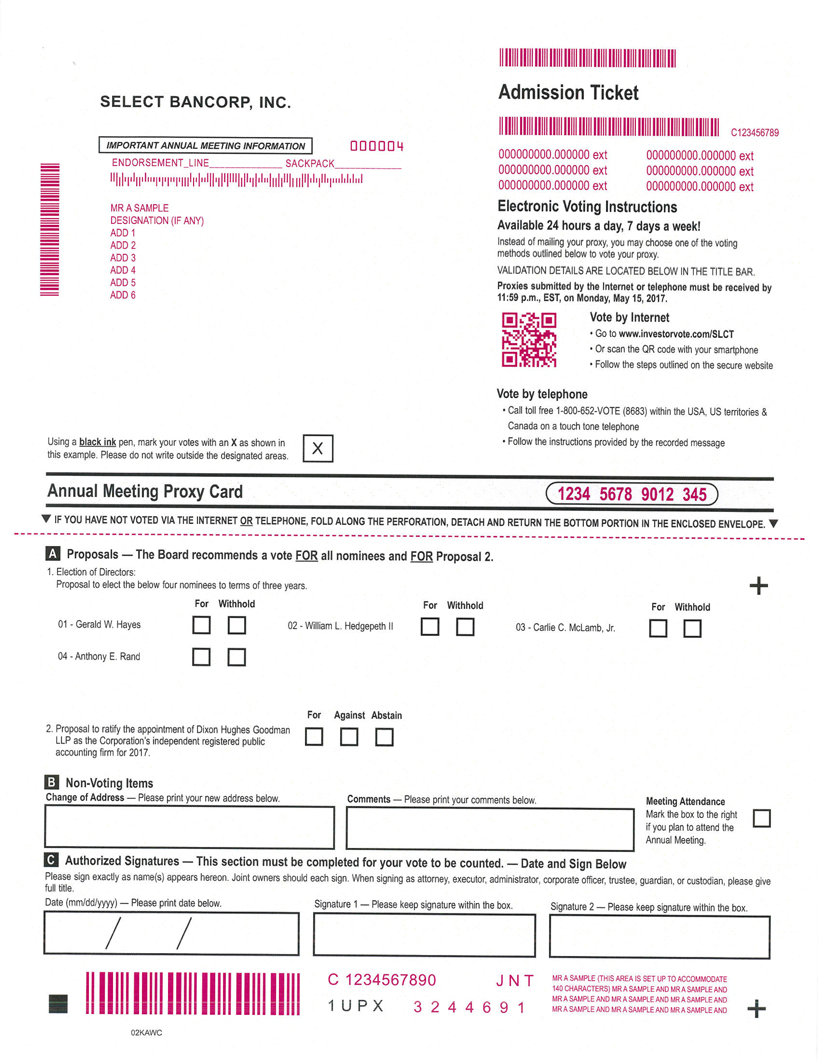

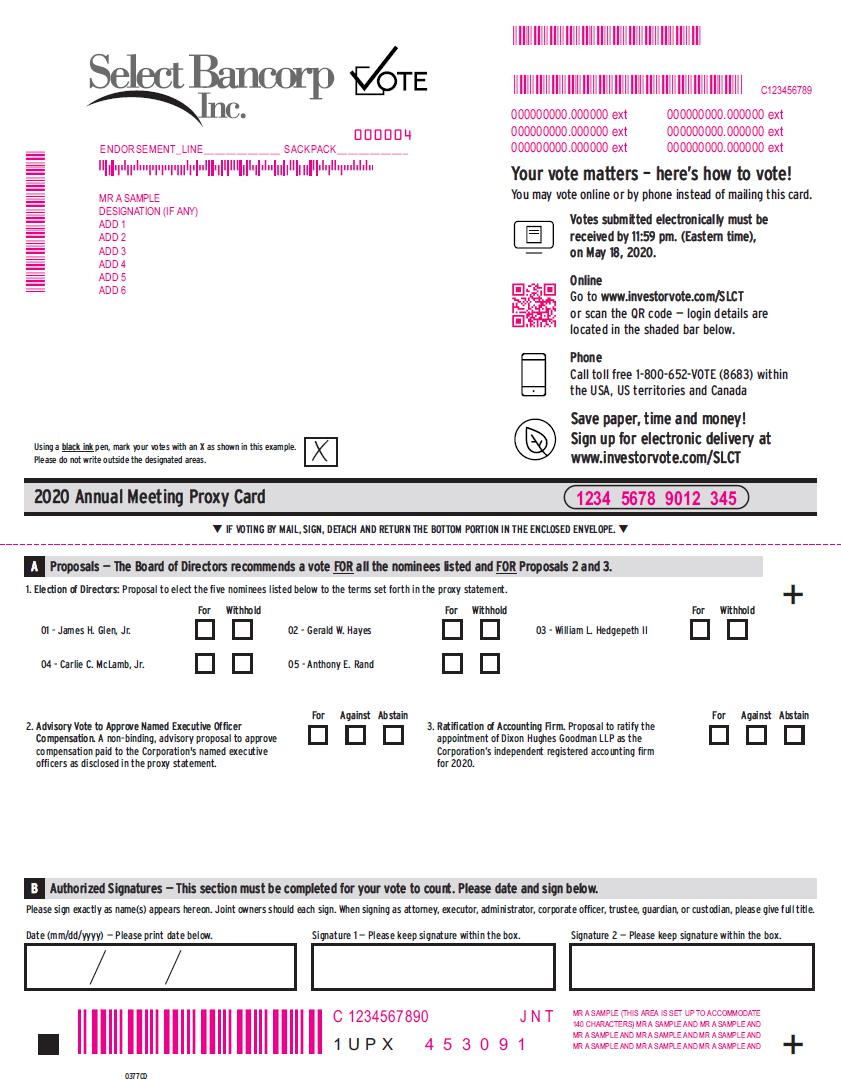

You are cordially invited to attend the annual meeting in person. However, even if you plan to attend, you are requested to complete, sign and date the enclosed appointment of proxy and return it promptly in the envelope provided for that purpose or to vote via the internet or telephone in order to ensure that a quorum is present at the meeting. The giving of an appointment of proxy will not affect your right to revoke it or to attend the meeting and vote in person.

Special Note Regarding COVID19. Given the public health and safety concerns related to the coronavirus disease 2019, or COVID19, we ask that each shareholder evaluate the relative benefits to them personally of in-person attendance at the annual meeting and take advantage of the ability to vote by proxy via internet or telephone, as instructed on the enclosed proxy card. If you elect to attend in person, we ask that you follow recommended guidance, mandates, and applicable executive orders from federal and state authorities, particularly as they relate to social distancing and attendance at public gatherings. If you are not feeling well or think you may have been exposed to COVID19, we ask that you vote by proxy for the meeting. Should further developments with COVID19 necessitate that we change any material aspects of the annual meeting, we will make public disclosure of such changes. We thank you for your cooperation as we balance both our fondness for shareholder engagement with the safety of our community and each of our shareholders.

We have elected to furnish our proxy solicitation materials via U.S. mail and also to notify you of the availability of our proxy materials on the internet. The notice of meeting, proxy statement, proxy card and annual report are available at: www.investorvote.com/SLCT.

| By Order of the Board of Directors | |

| |

| William L. Hedgepeth II | |

| President and Chief Executive Officer |

March 31, 2017April 9, 2020

SELECT BANCORP, INC.

700 West Cumberland Street

Dunn, North Carolina 28334

(910) 892-7080

PROXY STATEMENT

Mailing Date: On or about March 31, 2017April 9, 2020

ANNUAL MEETING OF SHAREHOLDERS

To Be Held

May 16, 201719, 2020

General

This Proxy Statement is furnished in connection with the solicitation of the enclosed appointment of proxy by the Board of Directors (the “Board”) of Select Bancorp, Inc. (the “Corporation”) for the Annual Meeting of Shareholders of the Corporation (the “Annual Meeting”) to be held at the Fairfield Inn & Suites, 513 Spring Branch Road,our main office located at 700 West Cumberland Street, Dunn, North Carolina 28334, at 10:00 a.m. on May 16, 2017,19, 2020, and any adjournments thereof.

Solicitation and Voting of Appointments of Proxy; Revocation

Persons named in the appointment of proxy as proxies to represent shareholders at the Annual Meeting are J. Gary Ciccone, Alicia S. Hawk, and Sharon L. Raynor, and John W. McCauley, whom we collectively refer to herein as the proxies. Shares represented by each appointment of proxy whichthat is properly executed and returned or appointed by internet or telephone, and not revoked, will be voted in accordance with the directions contained in the appointment of proxy. If no directions are given, each such appointment of proxy will be votedFOR the election of each of the fourfive nominees for director named in Proposal 1 below andFOR Proposal 2.Proposals 2 and 3. If, at or before the time of the Annual Meeting, any nominee named in Proposal 1 has become unavailable for any reason, the proxies will have the discretion to vote for a substitute nominee. On such other matters as may come before the meeting, the proxies will be authorized to vote shares represented by each appointment of proxy in accordance with their best judgment on such matters.

An appointment of proxy may be revoked by the shareholder giving it at any time before it is exercised by filing with Brenda B. Bonner, Vice President and Secretary of the Corporation, a written instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing his or her intention to vote in person.

Expenses of Solicitation

The Corporation will pay the cost of preparing, assembling and mailing this Proxy Statement and other proxy solicitation expenses. In addition to the use of the mails and the internet, appointments of proxy may be solicited in person or by telephone by officers, directors and employees of the Corporation and its subsidiary bank without additional compensation. The Corporation will reimburse banks, brokers and other custodians, nominees and fiduciaries for their costs in sending the proxy materials to the beneficial owners of the Corporation’s common stock.

Record Date

The close of business on March 17, 201719, 2020, has been fixed as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be eligible to vote on the proposals described herein.

Voting Securities

The voting securities of the Corporation are the shares of its common stock, par value $1.00 per share, of which 25,000,00050,000,000 shares are authorized and 11,660,57118,065,692 shares were outstanding on the Record Date. There were approximately 1,1211,058 record shareholders of the Corporation’s common stock as of the Record Date. Each shareholder of the Corporation’s common stock is entitled to one vote for each share held of record on the Record Date for each director to be elected and for each other matter submitted for voting.

Voting Procedures; Quorum; Votes Required for Approval

Shareholders will not be entitled to vote cumulatively in the election of directors at the Annual Meeting.

A majority of the shares of common stock of the Corporation issued and outstanding on the Record Date must be present in person or by proxy to constitute a quorum for the conduct of business at the Annual Meeting. Assuming a quorum is present, below are voting requirements for each of the proposals:

Proposal 1: Election of Directors. The fourfive nominees receiving the greatest number of votes shallwill be elected as directors of the Corporation.Corporation for the terms indicated under the description of Proposal 1 below.

Proposal 2: Advisory Vote to Approve Named Executive Officer Compensation. For Proposal 2 to be approved, the number of votes cast for approval must exceed the number of votes cast against the proposal.

Proposal 3: Ratification of Accounting Firm.For Proposal 23 to be approved, the number of votes cast for approval must exceed the number of votes cast against the proposal.

Abstentions and broker non-votes will have no effect on the outcome of the above proposals, other than for purposes of determining whether a quorum is present.

Authorization to Vote on Other Matters

By signing an appointment of proxy, shareholders will be authorizing the proxyholdersproxies to vote in their discretion regarding certain procedural motionsbest judgment on all other matters that may properly come before the Annual Meeting.Meeting for action by the shareholders, including any procedural motions.

Beneficial Ownership of Voting Securities

As of March 17, 2017,19, 2020, no shareholder known to management beneficially owned more than 5% of the Corporation’s common stock, except as disclosed in the following table.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(2) | Amount and Nature of Beneficial Ownership | Percent of Class(1) | ||||||||||||

Jeffrey S. Stallings(1) 1645 East Arlington Boulevard, Suite E Greenville, NC 27858 | 987,736 | 8.47 | % | |||||||||||||

| Gregory Blake Stallings(2) 1645 East Arlington Boulevard, Suite E Greenville, NC 27858 | 1,022,855 | 5.66 | % | |||||||||||||

| K. Clark Stallings(3) 1645 East Arlington Boulevard, Suite E Greenville, NC 27858 | 991,531 | 5.49 | % | |||||||||||||

| RMB Capital Management, LLC(4) 115 S. LaSalle Street, 34th Floor Chicago, IL 60603 | 925,693 | 5.12 | % | |||||||||||||

| (1) |

| The calculation of the percentage of class beneficially owned is based on a total of |

| (2) | Beneficial ownership is based on a Schedule 13G filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2019, and the information contained therein. Beneficial ownership includes 88,235 shares for which Gregory Blake Stallings has sole voting and investment power. Beneficial ownership also includes 750,186 shares held by The Bill and Faye Stallings Family Trust II and 184,434 shares held by The Marion Faye Stallings Living Trust. Gregory Blake Stallings is one of two trustees of the |

| (3) | Beneficial ownership is based on a Schedule 13D filed with the SEC on February 28, 2019 and the information contained therein and additional information reported to the Corporation since the filing date of the Schedule 13D. Beneficial ownership also includes the following shares for which K. Clark Stallings has sole voting and investment power: 19,977 shares held individually, 24,648 shares held by trusts for the |

| (4) | Beneficial ownership is based on information provided to the Corporation by a representative of RMB Capital Management, LLC (a registered investment adviser). |

As of March 17, 2017,19, 2020, the beneficial ownership of the Corporation’s common stock, by directors and executive officers individually, and by directors and executive officers as a group, was as follows:

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) (2) | Percent of Class(3) | ||||||

J. Gary Ciccone(4) Fayetteville, NC | 149,179 | 1.28 | ||||||

James H. Glen, Jr. (5) Charlotte, NC | 41,053 | * | ||||||

Oscar N. Harris(6) Dunn, NC | 411,836 | 3.53 | ||||||

Alicia Speight Hawk(7) Greenville, NC | 35,063 | * | ||||||

| Gerald W. Hayes Dunn, NC | 136,711 | 1.17 | ||||||

| William L. Hedgepeth II Fayetteville, NC | 73,340 | * | ||||||

| Ronald V. Jackson Clinton, NC | 49,129 | * | ||||||

| Lynn Holland Johnson Fuquay-Varina, NC | 5,850 | * | ||||||

| John W. McCauley Fayetteville, NC | 65,582 | * | ||||||

Carlie C. McLamb, Jr.(8) Dunn, NC | 95,111 | * | ||||||

| V. Parker Overton Grimesland, NC | 153,123 | 1.31 | ||||||

Anthony E. Rand(9) Fayetteville, NC | 84,805 | * | ||||||

Sharon L. Raynor(10) Dunn, NC | 276,324 | 2.37 | ||||||

K. Clark Stallings(11) Greenville, NC | 53,879 | * | ||||||

W. Lyndo Tippett (12) Fayetteville, NC | 39,394 | * | ||||||

| D. Richard Tobin, Jr. Smithfield, NC | 650 | * | ||||||

| All Directors and Executive Officers as a group (18 persons) | 1,672,274 | 14.21 | ||||||

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) (2) | Percent of Class (3) | ||||||

| W. Keith Betts | 4,150 | * | ||||||

| J. Gary Ciccone(4) | 167,653 | * | ||||||

| James H. Glen, Jr.(5) | 75,275 | * | ||||||

| Alicia Speight Hawk(6) | 39,676 | * | ||||||

| Gerald W. Hayes | 148,889 | * | ||||||

| William L. Hedgepeth II | 91,597 | * | ||||||

| Ronald V. Jackson | 63,113 | * | ||||||

| Mark. A Jeffries | 6,520 | * | ||||||

| Lynn H. Johnson | 5,940 | * | ||||||

| John W. McCauley | 77,594 | * | ||||||

| Carlie C. McLamb, Jr.(7) | 111,702 | * | ||||||

| V. Parker Overton | 161,736 | * | ||||||

| Anthony E. Rand(8) | 98,960 | * | ||||||

| Sharon L. Raynor(9) | 288,261 | 1.60 | % | |||||

| K. Clark Stallings(10) | 991,531 | 5.49 | % | |||||

| W. Lyndo Tippett(11) | 44,507 | * | ||||||

| D. Richard Tobin, Jr. | 3,120 | * | ||||||

| All Directors and Executive Officers as a group (17 persons) | 2,380,924 | 13.09 | % | |||||

| * | Represents beneficial ownership of less than one percent of the class. |

| (1) | Except as otherwise noted, to the best knowledge of the Corporation’s management, the above individuals and group exercise sole voting and investment power with respect to all shares shown as beneficially owned other than the following shares as to which such powers are shared: |

| (2) | Included in the beneficial ownership tabulations are the following |

| (3) | The calculation of the percentage of class beneficially owned by each individual and the group is based on the sum of (i) a total of |

| (4) | Includes |

| (5) | Includes |

| (6) |

| Includes 3,078 shares held as custodian for |

| Includes |

| Includes |

| Includes |

| (10) | Includes the following shares for which Mr. Clark Stallings has sole voting and |

| Includes 1,742 shares owned by Mr. Tippett’s spouse. |

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports

Directors, and executive officers and beneficial owners of more than 10% of the common stock of the Corporation are required by federal law to file reports with the Securities and Exchange Commission (the “SEC”) regarding the amount of, and changes in, their beneficial ownership of the Corporation’s common stock. Based upon a review of copies ofsuch reports received byand any amendments thereto filed electronically with the Corporation,SEC during the most recently completed fiscal year, all required reports of directors, and executive officers, and 10% beneficial owners of the Corporation during 20162019 were filed on a timely basis, with the exception of one(1) a late Form 4 of Ms. Alicia Speight Hawk, whichthat was filed by Mr. Glen to report a stock option exercise in each of July 2015 and November 2016 that was not previously reported, and (2) two late dueForm 4s that were filed to an administrative error.report Mr. C. Stallings becoming co-trustee of two family trusts in July 2018 that hold ownership interests in the Corporation and a sale transaction by Mr. C. Stallings’s spouse that occurred in September 2018.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board has set the number of directors of the Corporation at fourteen (14)thirteen (13). Pursuant to the Corporation’s bylaws, the Board is divided into three classes of directors, with each class being as nearly equal in number as possible. In order to balance our director classes into as nearly equal in number as possible, the Nominating Committee has recommended four directors for three-year terms and one director for a one-year term. The Board recommends that shareholders vote for the nominees listed below each for a term of three years.the respective terms set forth in the table below.

| Name and Age | Length of Term Nominated | Position(s)

| Director Since(1) | Principal Occupation and

| ||||

| 3 years | Director | ||||||

| Gerald W. Hayes (76) | 3 years | Director | 2003 | President and Managing Partner, Hayes, Williams, Turner & Daughtry, P.A. (law practice) | ||||

| William L. Hedgepeth II | 3 years | Director, President and CEO | 2007 | President and Chief Executive Officer, Select Bancorp, Inc. and Select Bank & Trust since |

|

| |||||||

| ||||||||

Carlie C. McLamb, Jr. | 3 years | Director | 2010 | President, Carlie C’s Operation Center, Inc., d/b/a Carlie C’s IGA (grocery stores) | ||||

| Anthony E. Rand | 1 year | Director | 2003 | President, Rand & Gregory, |

| (1) | Reflects the year |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR LISTED ABOVE FOR ATHE TERM OF THREE YEARS.INDICATED IN THE TABLE.

Incumbent Directors

The Corporation’s Board of Directors includes the following directors whose terms will continue after the Annual Meeting. Certain information regarding those directors is set forth in the following table.

| Name and Age | Position(s) Held | Term Expires | Director Since(1) | Principal Occupation and Business Experience During the Past Five Years | ||||

| Alicia Speight Hawk (53) | Director | 2021 | 2014 | Director of Advancement, The Oakwood School, (college preparatory school), Greenville, NC | ||||

| John W. McCauley (52) | Director | 2021 | 2003 | Chief Executive Officer, Highland Paving Co, LLC; General Manager, McCauley McDonald Investments, Inc. (commercial real estate firm), Fayetteville, NC | ||||

| Sharon L. Raynor (62) | Director | 2021 | 2009 | President and Director, LIFE, Inc. (provider of long-term care for developmentally disabled consumers), Goldsboro, NC | ||||

| J. Gary Ciccone (73) | Chairman | 2022 | 2003 | Real estate developer; Co-owner and Vice President, Nimocks, Ciccone & Townsend, Inc. (commercial real estate brokerage) | ||||

| Ronald V. Jackson (78) | Director | 2022 | 2012 | President, Clinton Truck and Tractor Company | ||||

| V. Parker Overton (75) | Director | 2022 | 2014 | Real Estate Developer; Founder, Overton’s Sports Center | ||||

| K. Clark Stallings (52) | Director | 2022 | 2014 | Vice President, Stallings Group, Ltd., Greenville, NC | ||||

| W. Lyndo Tippett (80) | Director | 2022 | 2008 | Certified Public Accountant; former Secretary, State of North Carolina Department of Transportation |

| (1) |

|

| ||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

| ||||||

|

Qualifications of Directors

A description of the specific experience, qualifications, attributes, or skills that led to the conclusion that each of the nominees and incumbent directors listed above should serve as a director of the Corporation is presented below. In July 2014, the Corporation (then known as New Century Bancorp, Inc.) merged with Select Bancorp, Inc., Greenville, NC, with the Corporation being renamed Select Bancorp, Inc. following the merger. Similarly, the Corporation’s subsidiary bank (then known as New Century Bank) merged with Select Bank & Trust Company, Greenville, NC, with the Corporation’s subsidiary bank being renamed Select Bank & Trust Company. For ease of reference, when we refer to either of the former Greenville-based entities in describing our directors’ experience, we so indicate by adding “Greenville” in parenthetical following the respective entity’s name.

J. Gary Ciccone.Mr. Ciccone has served as chairman of the board of directors of New Century Bankthe Corporation and New Century Bancorpits subsidiary bank since April 2008 and2008. He was a founding director of New Century Bank of Fayetteville, serving as chairman of the board of that institution from inception until its merger with New Century Bank.the Corporation’s subsidiary bank in March 2008. Mr. Ciccone retained the title of chairman following the 2014 mergers of the Corporation and its subsidiary bank with Select Bancorp (Greenville) and Select Bank & Trust (Greenville). Mr. Ciccone has completed the North Carolina Bank Directors’ College and Advanced Bank Directors’ College programs. As ownerco-owner and vice president of Nimocks, Ciccone & Townsend in Fayetteville, he has extensive experience in real estate development and commercial real estate brokerage and has also developed and managed numerous commercial properties.brokerage. Mr. Ciccone also has prior experience as a bank director, serving on the board of directors and as secretary of New East Bank of Fayetteville. He served on the Board of Trustees of Fayetteville Technical Community College from 2005 to 2009 and he also served on the North Carolina Board of Transportation from November 2009 to October 2011. Mr. Ciccone holds a Bachelor of Science in Business Administration from the University of North Carolina at Chapel Hill and a law degree from the University of North Carolina School of Law, Chapel Hill, NC. He was engaged in the active practice of law from 1975 to 1996 and is a member of the North Carolina State Bar.

James H. Glen, Jr.Mr. Glen was a founding director of Select Bank & Trust (Greenville) and Select Bancorp (Greenville). As a director, he was active as chairman of both the Auditaudit and Asset/Liability Managementasset/liability management (“ALCO”) Committees.committees. Mr. Glen has completed the North Carolina Bank Directors’ College and Advanced Bank Directors’ College programs. He began his career as a corporate lender in the commercial and industrial loan department of the Prudential Insurance Company of America in Atlanta making loans to small businesses throughout the Southeast. In 1979, he joined the Robinson Humphrey Company as an investment banker in Atlanta and developed a community bank practice in providing capital, merger and acquisition advice. In 1982, he moved to Charlotte and joined the investment banking department of Interstate Securities, which became Wachovia Securities. In 2004, he retired from Wachovia and formed Corporate Value Securities,Solutions, LLC as a value consultant, which continues as a private investment firm. He is currently a member of Glen & Hewett, LLC, which acts as a consultant to community banks. Mr. Glen is retired from the U.S. Army. He holds a bachelor’s degree from North Georgia College and an MBA from Georgia State College. He holds the designation as an Accredited Senior Appraiser (Business Valuation)(business valuation) of the American Society of Appraisers.

Oscar N. Harris. Mr. Harris was a founding director of New Century Bank and New Century Bancorp and has served as a member of the board of directors since inception. He has completed the North Carolina Bank Directors’ College and the Advanced Bank Directors’ College programs. Mr. Harris is a Certified Public Accountant and is senior partner and president of Oscar N. Harris & Associates, P.A., Dunn, NC. His background provides valuable financial and accounting expertise to the bank’s board of directors and the Audit/Risk Committee, which Mr. Harris chairs. In addition to his accounting background, Mr. Harris is also involved in numerous real estate development and management businesses. In addition, he is involved in government service contracting (federal and state). He served as a North Carolina State Senator from 1999 to 2002 and currently serves as Mayor of the City of Dunn. Mr. Harris has extensive prior bank director experience, formerly serving on the board of directors of First Federal Savings Bank from 1987 to 1988 and as a director of Standard Bank & Trust from 1988 to 1996. Mr. Harris was awarded the Man of the Year in Dunn, NC in 1986 and again in 2006 and received the Boy Scouts of America Distinguished Service Award in 1997. Mr. Harris currently serves as a member of the board of trustees of Campbell University where he is on the executive committee and audit committee. He also served as the chairman of Campbell University Medical School Founders Board. Mr. Harris attended Edwards Military Academy, Salemburg, NC, and he holds a Bachelor of Science degree in Business Administration from Campbell University, Buies Creek, NC and is an honors graduate.

Alicia S. Hawk. Mrs. Hawk was a founding director of Select Bank & Trust (Greenville) and Select Bancorp (Greenville), serving as vice chair from 2004 to 2014. She has completed the North Carolina Bank Directors’ College. Mrs. Hawk has served as the director of advancement for The Oakwood School in Greenville, NC since 2012. From 2006 to 2012, Mrs. Hawk was a member of the board of trustees at The Oakwood School and served as president from 2009-2012.2009 to 2012. As a former licensed real estate broker, Mrs. Hawk has extensive experience in real estate development, management, and commercial real estate brokerage, where shehaving served as a real estate asset manager offor Speight Properties in Greenville, NC from 2004-2012. She currently holds a NC Real Estate Brokerage License.2004 to 2012. Mrs. Hawk also has over ten years of consulting engineering experience with CDM Smith in Raleigh, NC and Atlanta, GA. Mrs. Hawk isGA and was previously a NC Registered Professional Engineer. She holds a Bachelor of Science degree in Civil Engineering and a Masters of Civil Engineering from North Carolina State University in Raleigh, NC.

Gerald W. Hayes. Mr. Hayes was a founding director of New Century Bank and New Century Bancorp and has served as a member of the board of directors since inception. Mr. Hayes is chairman of the Compensation Committee. He has completed the North Carolina Bank Directors’ College. Mr. Hayes is the president and managing partner of Hayes, Williams, Turner & Daughtry, P.A. and has practiced law in Harnett County for over 4050 years, providing the board with excellent perspective on legal issues and the Harnett County market area in general. He is also a member and co-owner of Chicora Golf Club in Dunn. Mr. Hayes holds a Bachelor of Arts degree from the University of North Carolina at Chapel Hill where he majored in Economics and a law degree from Wake Forest University Law School, Winston-Salem, NC.

William L. Hedgepeth II.Mr.. Mr. Hedgepeth has served as the President and Chief Executive Officer of Select Bank & Trustthe Corporation and Select Bancorpits subsidiary bank since 2008. He previouslyPrior to that, he served as president and chief executive officer of New Century Bank and New Century Bancorp andSouth (formerly known as president and chief executive officer of New Century Bank of Fayetteville.Fayetteville). Mr. Hedgepeth has more than 3336 years of experience in banking. He has completed the North Carolina Bank Directors’ College and Advanced Bank Directors’ College programs. He has also completedprograms, as well as the North Carolina Bankers Association’s (“NCBA”) Advanced Management Program andProgram. He served on the boardBoard of directorsDirectors of the North Carolina Bankers AssociationNCBA from 2008 to 2010. Mr. Hedgepeth2010 and currently serves on the North Carolina Banker’s AssociationNCBA’s Legislative and Regulatory Committee. In 2017, he completed The BB&T Leadership Institute’s Mastering Leadership Dynamics. Mr. Hedgepeth was appointed by North Carolina Governor Roy Cooper to serve on the Fayetteville Technical Community College board of trustees for a 3-year term beginning in 2017. He also serves on the Airborne and Special Operations Museum Board, the Greater Fayetteville Chamber of Commerce Board as treasurer and the United Way of Cumberland County Board. He alsoMr. Hedgepeth serves on the Vision 2026 Board.board of directors in Fayetteville/Cumberland County. He serves on the Highland Country Club Board of Directors as treasurer. In addition, Mr. Hedgepeth currently serves on the American Bankers Association 2020 Membership Council and the Community Depository Institutions Advisory Council of the Federal Reserve Bank of Richmond. Mr. Hedgepeth holds a Bachelor of Arts degree from the University of North Carolina at Chapel Hill.

Ronald V. Jackson.Jackson. Mr. Jackson served on the New Century Bank board of directors in 2002, and on the Dunn and Clinton Advisory Boards. He has served on the Corporation’s and its subsidiary bank’s boards since 2012. Mr. Jackson currently serves as chairman of the Nominating Committee. Mr. Jackson owns and operates Clinton Truck and Tractor Company, aan 85-year old local firm where he began working in 1972. Prior to joining Clinton Truck and Tractor, he worked for International Harvester. He has completed the North Carolina Bank Directors’ College. A graduate of North Carolina State University in Raleigh, NC, he received his degree in agricultural engineering.

John W. McCauley. Mr. McCauley was a founding member of New Century Bank of Fayetteville and has served as a member of the Corporation’s and its subsidiary bank’s boards of directors since 2004. He serves as chairman of the bank’s Loan Committee. Mr. McCauley is chief executive officer of Highland Paving Co., LLC, which is a highway construction firm engaged primarily in the manufacture and placement of hot mix asphalt. He also is general manager of McCauley-McDonald Investments, Fayetteville, NC.NC, which owns and leases approximately 70 commercial properties in North Carolina. He has completed the North Carolina Bank Directors’ College and holds a Bachelor of Science in Economics from Davidson College, Davidson, NC and a law degree from the University of North Carolina School of Law, Chapel Hill, NC.

Carlie C. McLamb, Jr.Mr. McLamb has served on the Corporation’s and its subsidiary bank’s boards of directors since 2010. Mr. McLamb is president of Carlie C’s IGA, a retail supermarket chain with numerous stores. Mr. McLamb was a founding director of Computer World Inc., and has served as a director and former chairman of the board of that company. In addition, he is currently serving on the board of directors for the North Carolina Retail Merchants Association and as a trustee of Campbell University. Mr. McLamb has completed the North Carolina Advanced Bank Directors’ College program. Mr. McLamb is also a current directorpast President of the Carolina Food Industry Council.

V. Parker Overton. Mr. Overton was a founding member of Select Bank & Trust (Greenville) and Select Bancorp (Greenville), NC where he served as chairman of the board from 2005 to July 2014. He currently serves as chairman of the Bank’sbank’s Building Committee. Mr. Overton is the founder of Overton’s, the world’s largest catalog of watersports and boating supplies. He was president of the NC State Veterinary Medical Foundation for three years and also served as chairman of the investment committee for 7 years. He served on the Home Federal Savings and Loan board from 1986 to 1991. He currently serves as an ambassador of Vidant Medical Foundation and also serves on the investment committee of the Randall Terry Foundation for North Carolina State University. He previously served three years as chairman of the finance committee at the former University Health Foundation. Mr. Overton was a founding director and served on the board of Metrics Pharmaceuticals from 1999 until 2012. Mr. Overton also serves as the chairman of the finance committee for Greenville Utilities.Utilities Commission and is the Commission’s chair-elect. He is also active in the commercial real estate business, and he is also a pilot typed in three different jets.

Anthony E. Rand. Mr. Rand was a founding director of New Century Bank of Fayetteville and has served as a member of the Corporation’s and its subsidiary bank’s boards of directors since 2004. Mr. Rand previously served as a member and chair of the North Carolina Education Lottery Commission until December 2019. He served in the North Carolina Senate for 22 years and was the Senate Majority Leader in 1987-1988 and from 2001-2009. He served as chairman and a member of the North Carolina Post-Release Supervision and Parole Commission (2010-2013) and was an associate vice president of Fayetteville Technical Community College.College (2014-2015). He served as a consultant to Carolina Lithotripsy from 2010 to 2015. He has completed the North Carolina Advanced Bank Directors’ College. Mr. Rand holds a Bachelor of Arts in Political Science from the University of North Carolina at Chapel Hill and a law degree from the University of North Carolina School of Law, Chapel Hill, NC. Mr. Rand is president of the law firm of Rand & Gregory, P.A., Fayetteville, NC and has served on numerous boards and commissions including the board of directors of the General Alumni Association of the University of North Carolina, an organization for which he currently serves as Treasurer. Mr. Rand has prior experience as a bank director, formerly serving on the board of State Bank, Fayetteville, NC and on the local advisory board for First Citizens Bank.

Sharon L. Raynor. Mrs. Raynor has served as a director of the Corporation and its subsidiary bank since 2005. She currently chairs the bank’s ALCO Committee. She has completed the North Carolina Bank Directors’ College. She is president, a director, and an owner of LIFE, Inc., a provider of long termintermediate care for the developmentally disabled for area mental health agencies throughout eastern North Carolina. She is also an investor and partner in the hospitality industry. Mrs. Raynor is very involved in the bank’s local community, serving as an active member of Divine Street United Methodist Church, a member of the Lucknow Garden Club, and formerly on the Dunn Schools’ advisory board. She worked in the public schools for seven years as a special education teacher. She is a memberteacher of the American Association on Intellectual and Developmental Disabilities.students with intellectual developmental disabilities. She served on the Governor’s Council onof Exceptional Children, having been appointed by former North Carolina Governor James B. Hunt. She has served several terms on the Professional Advisory Board for the School of Education at East Carolina University. Mrs. Raynor holds a Bachelor of Science in Special Education from East Carolina University, Greenville, NC.

K. Clark Stallings. Mr. Stallings served as a director of Select Bank & Trust (Greenville) and Select Bancorp (Greenville) prior to joining the Corporation’s board of directors in 2014. He has completed the North Carolina Bank Directors’ College. He is managerVice President of Stallings Group Ltd., and he is active in different businesses including auto & consumer finance, automobile auction, auto dealer floor plan financing, Jersey Mike’s Subs restaurants, and commercial income producing real estate. Mr. Stallings is co-founder of Hope of Glory Ministries, a faith basedfaith-based community outreach to help people in need through the distribution of food, clothes, household resources, and hygiene items. He is a 1989 graduate of East Carolina University, Greenville, NC, with a degree in business management.

W. Lyndo Tippett. Mr. Tippett was a founding director of New Century Bank of Fayetteville and has served as a member of the Corporation’s and its subsidiary bank’s boards of directors since 2008. He has completed the North Carolina Bank Directors’ College program. Mr. Tippett has been a certified public accountant for over 45 years and is a member of the American Institute of Certified Public Accountants and the North Carolina Association of Certified Public Accountants. He was a partner in the accounting firm of Tippett Bryan & Merritt, CPAs, Fayetteville, NC from 1976-20151976 to 2015 and currently practices as W. Lyndo Tippett, CPA.CPA (sole proprietorship). Additionally, Mr. Tippett served as Secretary of Transportation for the State of North Carolina from 2001 through 2009 and served as a member of the North Carolina Board of Transportation for eight years prior to becoming secretary. He served as a director of the North Carolina State Health Plan offor Teachers and State Employees from 2009 through 2011. He was chief executive officer of Bybon, Inc., a manufacturing, retail and real estate concern, from 1970 through 1976. He previously served as a staff accountant with Ernst & Young. Mr. Tippett holds a Bachelor of Science in accounting from Barton College. He also has prior experience as a bank director, having served on the board of State Bank, Fayetteville, NC and on the local advisory board for First Citizens Bank.

Board Leadership Structure

The Board of Directors appoints a chairman, who presides at meetings of the Board and performs such other duties as may be directed by the Board. The Board may select any of its members as its chairman, and it has no formal policy as to whether the Corporation’s chief executive officer will serve as chairman or whether any other director, including a non-employee or independent director, may be elected to serve as chairman. The positions of chief executive officer and chairman are currently held by different persons. At this time, the Board has determined that separating these roles and having an independent director serve as chairman of the Board is in the best interests of our shareholders. The Board believes this division of responsibility facilitates communication between the Board and executive management and is appropriate given the legal and regulatory requirements applicable to the Corporation.

Board’s Role in Risk Oversight

Risk is inherent in any business, and, as is the case with other management functions, the Corporation’s senior management has primary responsibility for managing the risks faced by the Corporation. However, as a financial institution, the Corporation’s business involves financial risks that do not exist or that are more extensive than the risks that exist in some other types of businesses. The Corporation and its subsidiary bank are subject to extensive regulation that requires us to assess and manage those risks, and our regulators assess our performance in managing those risks during their periodic examinations. As a result, the Board is actively involved in overseeing our risk management programs.

The Board administers its oversight function primarily through committees. Additional information regarding the Board’s committees appears below. The Board approves and periodically reviews the Corporation’s operating policies and procedures. We believe the Board’s involvement in our risk management results in Board committees that are more active than those of corporations that are not financial institutions or that are not regulated as extensively as financial institutions. We believe this committee activity enhances our Board’s effectiveness and leadership structure by providing opportunities for non-employee directors to become familiar with the bank’s critical operations and actively involved in the Board’s oversight role with respect to risk management, as well as its other oversight functions.

Policies and Practices related to Hedging Activity of Corporation Securities

The Corporation has not adopted any formal practices or policies regarding the ability of the Corporation’s employees, officers, or directors (or any of their designees), to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Corporation’s capital stock (i) granted to the employee or director as part of the individual’s compensation or (ii) held, directly or indirectly, by such employee or director.

Director Independence

With the exception of Mr. Hedgepeth, each member of the Corporation’s Board of Directors is “independent” as defined by NASDAQ listing standards and the regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In making this determination, the Board considered certain insider transactions with directors for the provision of goods or services to the Corporation and its subsidiary bank. All such transactions were conducted at arm’s length upon terms no less favorable than those that would be available from an independent third party.

Director Relationships

With the exception of Messrs. Rand and Tippett, each of whom previously served as a director of Law Enforcement Associates Corporation, Raleigh, North Carolina until 2012, noNo director of the Corporation is, or has in the last five years been, a director of any other company with a class of securities registered pursuant to Sectionsection 12 of the Exchange Act or subject to the requirements of Sectionsection 15(d) of the Exchange Act, or any company registered as an investment company under the Investment Company Act of 1940.1940, as amended.

There are no family relationships among directors, nominees or executive officers of the Corporation.

Meetings and Committees of the Board of Directors

The Corporation’s Board of Directors held twelvethirteen meetings during 2016. None2019. With the exception of Mr. McCauley, none of the Corporation’s incumbent directors attended fewer than 75% of all board meetings and the meetings of any committee(s) of which he or she was a member. Mr. McCauley, who did attend a majority of the Corporation’s board meetings, had his ability to attend meetings impacted during 2019 by both personal medical issues and medical issues related to his family.

It is the policy of the Corporation that directors attend each annual meeting of shareholders.Thirteen of the fourteen16 members of the Corporation’s Board of Directors then in office attended the 20162019 Annual Meeting of Shareholders. The Corporation’s Board has several standing committees including an Audit/Audit and Risk Management Committee, a Nominating Committee and a Compensation Committee.

Audit/Audit and Risk Management Committee.The current members of the Audit/Audit and Risk Management Committee are J. Gary Ciccone, Oscar N. Harris (chairman), James H. Glen, Jr., Anthony E. Rand, K. Clark Stallings, and W. Lyndo Tippett.Tippett (chairman). The members of the committee are “independent” as defined by NASDAQ listing standards and the regulations promulgated under the Securities Exchange Act of 1934 and are financially literate. The Audit/Audit and Risk Management Committee met six times during 2016.2019. The Board of Directors has adopted a written Audit/Audit and Risk Management Committee Charter, which is available under the Corporate Governance link in the Investor Relations section of our website, www.selectbank.com. The report of the Audit/Audit and Risk Management Committee is included below following the discussion of Proposal 2.3.

The Board of Directors has determined that Oscar N. Harris,W. Lyndo Tippett, a member of the Audit/RiskCommittee,Audit and Risk Management Committee, meets the requirements adopted by the SEC for qualification as an “audit committee financial expert.” An audit committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of Generally Accepted Accounting Principles (U.S.) in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that are of the same level of complexity that can be expected in the registrant’s financial statements, or experience supervising people engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

Nominating Committee. The duties of the Nominating Committee are: (i) to assist the Board of Directors, on an annual basis, by identifying individuals qualified to become board members, and to recommend to the Board the director nominees for the next meeting of shareholders at which directors are to be elected; and (ii) to assist the Board of Directors by identifying individuals qualified to become board members, in the event that a vacancy on the Board exists and that such vacancy should be filled.

The current members of the Nominating Committee are J. Gary Ciccone, James H. Glen, Jr., Gerald W. Hayes, Ronald V. Jackson (chairman), Carlie C. McLamb, Jr. and Anthony E. Rand, each of whom is “independent” as defined by NASDAQ listing standards and applicable SEC rules and regulations. The nominating committee met once during 2016.2019. The Bylaws of the Corporation state that candidates may be nominated for election to the Board of Directors by the Nominating Committee or by any shareholder of the Corporation’s common stock. It is the policy of the Nominating Committee to consider all shareholder nominations. Shareholder nominations must be submitted to the Nominating Committee in writing on or before September 30th of the year preceding the annual meeting at which the nominee would stand for election to the Board of Directors and must be accompanied by each nominee’s written consent to serve as a director of the Corporation if elected. The Bylaws of the Corporation require that all nominees for director, including shareholder nominees, have business, economic or residential ties to the Corporation’s market area. In evaluating nominees for director, the Nominating Committee values community involvement and experience in finance or banking including prior service as an officer or director of an entity engaged in the financial services business, although such experience is not a prerequisite for nomination. Although there is not currently a formal policy requiring that the Nominating Committee consider diversity in its identification of nominees to the Board of Directors, the committee values diversity, including diversity of background, experience and expertise.

The Nominating CommitteeBoard of Directors has adopted a formal written Nominating Committee charter whichthat is reviewed annually for adequacy and which is available under the Corporate Governance link in the Investor Relations section of our website, www.selectbank.com.www.selectbank.com. Each of the nominees for election to the Board of Directors included in this proxy statement was nominated by the Nominating Committee.

Compensation Committee. The current members of the Compensation Committee are J. Gary Ciccone, Gerald W. Hayes (chairman), Alicia S. Hawk, John W. McCauley, and V. Parker Overton. The Compensation Committee meets on an as neededas-needed basis to review the salaries and compensation programs required to attract and retain the Corporation’s executive officers. The Compensation Committee met threefour times during 2016.2019. The Committee approves the compensation of the President and Chief Executive Officer. The compensation of officers that report to the President, including the Chief Financial Officer, Chief Banking Officer, Chief AdministrativeOperating Officer and Chief Credit Officer, is recommended by the President and Chief Executive Officer based on such officer’s experience, managerial effectiveness, contribution to the Corporation’s overall profitability, maintenance of regulatory compliance standards and professional leadership. The Committee compares the compensation of the Corporation’s executive officers with compensation paid to executives of similarly situated bank holding companies, other businesses in the Corporation’s market area, and appropriate state and national salary data. The Committee is not bound by recommendations made by the President and Chief Executive Officer. Furthermore, the President and Chief Executive Officer does not have any input into his own compensation. The Compensation Committee also engages third partythird-party compensation consultants on occasion to assist in determining executive pay or additional benefits, but does not delegate its duties. Please see the discussion below under the heading “Compensation Discussion and Analysis” for a detailed discussion of our compensation programs and practices.

The Board of Directors has adopted a written Compensation Committee Charter,charter, which is available under the Corporate Governance link in the Investor Relations section of the Corporation’s website, www.selectbank.com.

Compensation Committee Interlocks and Insider Participation

During 2019, no member of the Compensation Committee was an officer or employee of the Corporation, and none of the members of the Compensation Committee during the last fiscal year has ever been an officer of the Corporation. There were no interlocking relationships during the last fiscal year that require disclosure under applicable SEC rules.

Transactions with Related Persons

Policies and Procedures. Under its charter, the Audit and Risk Management Committee is charged with the responsibility of reviewing, approving and/or ratifying all transactions with “related persons,” as such term is defined under Item 404 of SEC Regulation S-K. The term “related person” is defined to include:

| · | any director or executive officer of the Corporation; |

| · | any immediate family member of a director or executive officer, which includes parents, children, stepparents, stepchildren, spouses, siblings and in-laws; |

| · | any shareholder owning more than five percent of our common stock; and |

| · | any immediate family member of a more than five percent holder of our common stock. |

Indebtedness of and Transactions with Management

. The Corporation’s bank subsidiary, Select Bank & Trust Company, has had, and expects to have in the future, banking and other transactions in the ordinary course of business with certain of its current directors, nominees for director, executive officers and associates. All such transactions are made on substantially the same terms, including interest rates, repayment terms and collateral, as those prevailing for comparable transactions with persons not related to the lender, and do not involve more than the normal risk of collection or present other unfavorable features. Loans made by Select Bank & Trust Company to directors and executive officers are subject to the requirements of Regulation O of the Board of Governors of the Federal Reserve System. Regulation O requires, among other things, prior approval of the Board of Directors with any “interested director” not participating, dollar limitations on amounts of certain loans and prohibits any favorable treatment being extended to any director or executive officer in any of the bank’s lending matters.

Director Compensation

Board Fees. Each director receives a fee of $1,000 for each meeting of the Corporation’s Board of Directors attended, with the exception of the chairman, who receives $1,100 for each meeting of the Corporation’s Board of Directors attended. Members of all committees of the Board of Directors receive $400 for each committee meeting attended, with the exception of committee chairs, who receive $500 per committee meeting attended. In addition, all non-employee members of the Board of Directors receive a quarterly retainer of $2,000, with the exception of the chairman, who receives a quarterly retainer of $2,125.

The Corporation has instituted a Directors’ Deferral Plan whereby individual directors may elect annually to defer receipt of all or a designated portion of their fees for the coming year. Directors’ fees deferred under the plan are used to purchase shares of the Corporation’s common stock by the administrator of the Deferral Plan, with such deferred compensation disbursed in the future as specified by the director at the time of his or her deferral election.

2010 Omnibus Stock Ownership and Long Term Incentive Plan.The2010 Omnibus Stock Ownership and Long-Term Incentive Plan was approved by the shareholders at the 2010 Annual Meeting. The 2010 Omnibus Plan provides for issuance of up to 250,000 shares of the Corporation’s common stock, including grants of non-qualified stock option grants to members of the Corporation’s Board of Directors. Please refer to page 17 of this proxy statement for more information regarding the 2010 Omnibus Stock Ownership and Long-Term Incentive Plan.

2000 Nonstatutory Stock Option Plan. The shareholders of New Century Bank ratified the 2000 Nonstatutory Stock Option Plan at the 2000 Annual Meeting. In connection with the reorganization of New Century Bank into the holding company form of organization, which resulted in the creation of the Corporation in 2003, the 2000 Nonstatutory Stock Option Plan was adopted by the Corporation and options under that plan were converted into options to purchase shares of the Corporation’s common stock. At the 2004 Annual Meeting, the shareholders of the Corporation approved an amendment to the 2000 Nonstatutory Stock Option Plan that increased the number of shares of the Corporation’s common stock available for issuance under the Plan. Under the terms of the Plan, options on a total of 478,668 shares (as adjusted for stock dividends) of the Corporation’s common stock were available for issuance to members of the Corporation’s Board of Directors and the board of any subsidiary of the Corporation.

Executive Compensation AND RELATED MATTERS

The 2000 Nonstatutory Stock Option Plan expired in June 2010. While no further stock options may be granted under the 2000 Nonstatutory Stock Option Plan, option recipients may still exercise any outstanding stock options for the balance of the exercise period (usually ten years) specified in the option recipient’s grant agreement.

Equity Plans of Legacy Select Bancorp (Greenville). In connection with the 2014 merger of Select Bancorp (Greenville) with and into the Corporation, the Corporation adopted the Select Bancorp, Inc. 2008 Omnibus Stock Ownership and Long Term Incentive Plan, the Amended and Restated Select Bancorp, Inc. 2005 Incentive Stock Option Plan and the Amended and Restated Select Bancorp, Inc. 2005 Nonstatutory Stock Option Plan. All outstanding stock options under such plans were converted into stock options covering shares of the Corporation’s common stock, as adjusted for the exchange ratio in the merger. No additional awards will be made by the Corporation out of the adopted plans.

The following table presents a summary of all compensation paid by the Corporation to its non-employee directors for their service as such during the year ended December 31, 2016.

DIRECTOR COMPENSATION TABLE

| Name of Director(1) | Fees Earned or Paid in Cash | Stock Awards | Option Awards | All Other Compensation | Total | |||||||||||||||

| J. Gary Ciccone | $ | 34,600 | — | — | $ | 882 | $ | 35,482 | ||||||||||||

| James H. Glen, Jr. | 24,800 | — | — | 3,141 | 27,941 | |||||||||||||||

| Oscar N. Harris | 25,200 | — | — | 244 | 25,444 | |||||||||||||||

| Alicia Speight Hawk | 25,500 | — | — | 1,021 | 26,521 | |||||||||||||||

| Gerald W. Hayes | 22,000 | — | — | 177 | 22,177 | |||||||||||||||

| Ronald V. Jackson | 20,600 | — | — | 795 | 21,395 | |||||||||||||||

| John W. McCauley | 25,200 | — | — | 387 | 25,587 | |||||||||||||||

| Carlie C. McLamb, Jr. | 26,800 | — | — | 376 | 27,176 | |||||||||||||||

| V. Parker Overton | 21,700 | — | — | 874 | 22,574 | |||||||||||||||

| Anthony E. Rand | 24,400 | — | — | 945 | 25,345 | |||||||||||||||

| Sharon L. Raynor | 22,000 | — | — | 376 | 22,376 | |||||||||||||||

| K. Clark Stallings | 24,000 | — | — | 744 | 24,744 | |||||||||||||||

| W. Lyndo Tippett | 27,200 | — | — | 1,128 | 28,328 | |||||||||||||||

Executive Officers

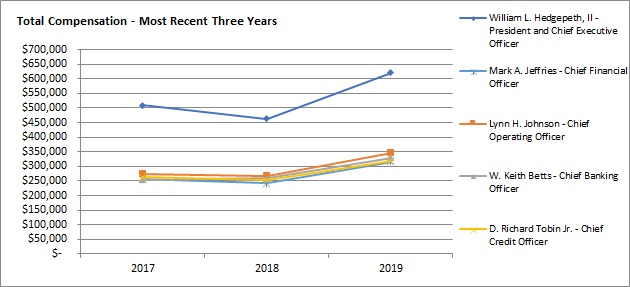

The following table sets forth certain information regarding the Corporation’s current executive officers. These five executive officers are our “named executive officers” for the 2019 fiscal year.

| Name | Age | Position with Corporation | Business Experience | |||||

| William L. Hedgepeth II | President and Chief Executive Officer | President and Chief Executive Officer of the Corporation and its subsidiary bank, | ||||||

| W. Keith Betts | Executive Vice President and Chief Banking Officer | Executive Vice President and Chief Banking Officer of the Corporation and its subsidiary bank, 2017-Present; Regional Executive, Select Bank & Trust, 2016; President and Chief Executive Officer, Port City Capital Bank, Wilmington, NC, 2001-2006. | ||||||

| Mark A. Jeffries | Executive Vice President and Chief Financial Officer | Executive Vice President and Chief Financial Officer of the Corporation and its subsidiary bank, 2014-Present; Executive Vice President and Chief Financial Officer, Millennium Bank, NA and its parent company, Millennium Bankshares Corporation, Sterling, VA, 2009-2014. | ||||||

| Lynn H. Johnson | Executive Vice President and Chief | Executive Vice President and Chief Operating Officer of the Corporation and | its subsidiary bank, 2017-Present; Executive Vice President and Chief Administrative Officer of the Corporation and its subsidiary bank, | |||||

| D. Richard Tobin, Jr. | Executive Vice President and Chief Credit Officer | Executive Vice President and Chief Credit Officer of the Corporation and its subsidiary bank, 2012-Present; Senior Vice President and Senior Credit Administrator, Select Bank & Trust (formerly New Century Bank), 2008-2012. |

Compensation Discussion and Analysis

This Compensation Discussion and Analysis is intended to assist our shareholders in understanding the Corporation’s compensation programs. It presents and explains the philosophy underlying our compensation strategy and the fundamental elements of compensation paid to our named executive officers (collectively, “named executive officers” or “NEOs”) whose 2019 compensation information is provided in the tables following this discussion. Our 2019 NEOs are the following:

| William L. Hedgepeth II | President and Chief Executive Officer |

| W. Keith Betts | Executive Vice President and Chief Banking Officer |

| Mark A. Jeffries | Executive Vice President and Chief Financial Officer |

| Lynn H. Johnson | Executive Vice President and Chief Operating Officer |

| D. Richard Tobin, Jr. | Executive Vice President and Chief Credit Officer |

Specifically, this Compensation Discussion and Analysis addresses the following:

| · | certain relevant 2019 business performance highlights; |

| · | our compensation philosophy and the objectives of our compensation programs; |

| · | what our compensation programs are designed to reward; |

| · | our process for determining executive officer compensation, including: |

| — | the role and responsibility of the Compensation Committee; |

| — | the role of the Chief Executive Officer and other named executive officers; |

| — | the role of compensation consultants; and |

| — | benchmarking and other market analyses; |

| · | elements of compensation provided to our executive officers, including: |

| — | the purpose of each element of compensation; |

| — | why we elect to pay each element of compensation; |

| — | how we determine the levels or payout opportunities for each element; and |

| — | decisions on final payments for each element and how these align with performance |

| · | other compensation and benefit policies affecting our executive officers. |

2019 Business Performance Highlights

The following is a list of certain of our 2019 business performance highlights, which are relevant when we consider and evaluate our compensation policies and the effectiveness of our compensation philosophies.

| · | Net income for the year ended December 31, 2019 of $13.8 million and basic and diluted earnings per share of $0.69 and $0.68, respectively compared to $13.8 million and basic and diluted earnings per share of $0.87, for the year ended December 31, 2018. |

| · | Total assets, deposits, and total loans for the Corporation as of December 31, 2019 were $1.3 billion, $992.8 million, and $1.0 billion, respectively, compared to total assets of $1.3 billion, total deposits of $980.4 million, and total loans of $986.0 million as of the same date in 2018. |

| · | For the twelve months ended December 31, 2019, return on average assets was 1.03% and return on average equity was 6.08%, compared to 1.12% and 8.51%, respectively, for the twelve months ended December 31, 2018. |

| · | Non-performing loans increased to $12.1 million at December 31, 2019 from $11.6 million at December 31, 2018. Non-performing loans equaled 1.18% of loans at December 31, 2019 and at December 31, 2018. Foreclosed real estate equaled $3.5 million at December 31, 2019, compared to $1.1 million at December 31, 2018. |

| · | For the year ended December 31, 2019, net charge-offs were $782,000, or 0.08% of average loans, compared to net charge offs of $10,000, or 0.00% of average loans in 2018. At December 31, 2019, the allowance for loan losses was $8.3 million, or 0.81% of total loans, as compared to $8.7 million, or 0.88% of total loans, at December 31, 2018. |

| · | Net interest margin was 4.04% for the year ending December 31, 2019, as compared to 4.19% for the year ending December 31, 2018. |

When considering such results, we do not view such results in isolation and believe it is important to consider trends, anomalies, and strategic initiatives so that long-term shareholder interests can be appropriately aligned with our compensation practices and philosophies.

The Compensation Committee believes that the most effective compensation programs strive to accomplish the following objectives:

| · | aligning the interests of the employee with those of the Corporation’s shareholders; |

| · | attracting and retaining talented individuals and top performers; and |

| · | motivating performance toward the achievement of short-term and long-term goals. |

To meet these objectives, the Compensation Committee has carefully structured the Corporation’s compensation programs in the following manner:

| · | base compensation levels benchmarked to, and competitive with, the 50th percentile of market, defined in terms of geography, company type, and company size, with actual base pay varying in a normal range around the 50th percentile based on individual performance and other factors; |

| · | annual incentive compensation that varies in a consistent manner with the achievement of both the financial and operating objectives of the Corporation and individual performance objectives, which together support our business strategy; |

| · | long-term incentive compensation (equity) that balances retention with the achievement of longer-term (minimum three year) financial and strategic goals; |

| · | executive benefits that are meaningful and competitive with, and comparable to, those offered by similar organizations; and |

| · | an appropriate balance between base pay, short-term incentives, long-term incentives, and benefits that provides a total target compensation opportunity that generally aligns with the market 50th percentile. |

In designing and administering the Corporation’s executive compensation program, the Compensation Committee strives to maintain an appropriate balance across all the various compensation elements, realizing that at times some objectives may be more difficult to achieve than others, or may even be in conflict with others. In addition, external factors, such as the general state of the economy and the banking industry or legislative changes impacting executive compensation, may impact the effectiveness of existing approaches to executive compensation. Such events require ongoing monitoring and a careful reconsideration of existing approaches by the Compensation Committee. On an annual basis, the Compensation Committee carefully evaluates and, where appropriate, makes decisions and adjustments to future compensation programs in an effort to consistently implement the strategic objectives of executive compensation.

Shareholder Outreach

At the 2019 Annual Meeting of Shareholders, approximately 76% of the voting shareholders approved the Corporation’s 2018 executive compensation program for the NEOs. We believe that these voting results reflect our shareholders’ endorsement and support of our executive compensation program and affirm alignment of our program with shareholder interests. We continue to maintain an active and open dialogue with our shareholders to identify ways to further refine and improve our executive compensation program, and the Compensation Committee believes our current program adequately and effectively addresses shareholder concerns, promotes the Corporation’s business strategy and aligns pay with performance and shareholder value.

Process for DeterminingNamed Executive Officer Compensation

Role of the Compensation Committee. The Compensation Committee administers the Corporation’s executive compensation program. Throughout 2019, the Compensation Committee included J. Gary Ciccone, Gerald W. Hayes (chairman), Alicia S. Hawk, John W. McCauley, and V. Parker Overton. The members of the Compensation Committee all qualify as “independent” directors in accordance with the requirements of NASDAQ and current SEC regulations.

The Compensation Committee is responsible for all compensation decisions for the Chief Executive Officer and the other NEOs. The Compensation Committee annually reviews the levels of compensation along with the performance results on goals and objectives relating to compensation for the NEOs. Based on this evaluation, the Compensation Committee makes decisions related to our executive compensation program with final approval by the Board, except where the Compensation Committee has otherwise been given final authority with respect to a specific component of compensation. Additionally, the Compensation Committee periodically reviews our incentive plans and other equity-based plans. The Compensation Committee reviews, adopts and submits to the Board any proposed arrangement or plan and any amendment to an existing arrangement or plan that provides or will provide benefits to the executive officers collectively or to an individual executive officer. The Compensation Committee has sole authority to retain and terminate compensation consultants and other advisors as it deems appropriate.

Compensation Program Risk. While the Compensation Committee did not formally review whether the compensation arrangements, agreements, and benefit plans of the Corporation made available to the NEOs and to all other employees of the Corporation unduly encourage those employees to take unnecessary and excessive risks that could threaten the financial condition of the Corporation, the Compensation Committee firmly believes that the compensation policies and practices in effect in 2019 did not encourage undue risk taking. The Compensation Committee will in the future review an inventory of its executive and non-executive compensation programs, with particular emphasis on incentive compensation plans or programs. The Committee will evaluate, with the assistance of appropriate officers of the Corporation, the primary components of its compensation plans and practices to identify whether those components, either alone or in combination, properly balance compensation opportunities and risk. The Compensation Committee will consider various risk-mitigating policies in connection with this analysis, including stock ownership requirements, incentive compensation, and a claw-back policy. The Committee expects to monitor and periodically evaluate our incentive compensation arrangements, agreements and benefit plans at least annually, as part of the Corporation’s oversight of risk management for the organization.

Please see the discussion under the heading “Board’s Role in Risk Oversight” on page 10 for additional discussion of our risk management practices.

Role of the Executive Officers.The Chief Executive Officer, with the assistance of the Corporation’s Chief Operating Officer, annually reviews the performance of the other NEOs, after which the Chief Executive Officer presents his conclusions and recommendations to the Compensation Committee for approval. The Compensation Committee has absolute discretion as to whether it approves the recommendations of the Chief Executive Officer or makes adjustments, as it deems appropriate. The Chief Executive Officer, Chief Financial Officer and Chief Operating Officer may also work with the Compensation Committee to gather and compile data needed for benchmarking purposes or for other analysis conducted by the Compensation Committee’s independent consultants and advisors.

Role of Compensation Consultant. In 2019, the Compensation Committee engaged Pearl Meyer & Partners, LLC (“Pearl Meyer”) to serve as the Compensation Committee’s independent compensation consultant. Pearl Meyer acquired the Compensation Committee’s prior consultant, Matthews, Young – Management Consulting, during the 2019 fiscal year. The Compensation Committee has sole authority to retain, terminate and approve the fees of its compensation consultant. In its role as the Compensation Committee’s independent advisor, Pearl Meyer attended Compensation Committee meetings and advised on matters including compensation program design, benchmarking of compensation, and relative pay for performance. Pearl Meyer also provided market data, analyses and advice regarding compensation of our NEOs and other executive officers. Pearl Meyer has not provided any services to the Corporation other than executive compensation consulting services provided to the Compensation Committee. The Compensation Committee considered the independence of Pearl Meyer in light of current SEC rules and NASDAQ listing standards and concluded that the work of Pearl Meyer did not raise any conflict of interest.

Benchmarking. The Compensation Committee reviews competitive data for comparable executive positions in the market. External market data is used by the Compensation Committee as a point of reference in its executive pay decisions in conjunction with financial and individual performance data. In considering the competitive environment, the Compensation Committee reviews compensation information disclosed by a peer group of comparatively sized companies with which we compete for business and executive talent and information derived from published survey data that compares the elements of each named executive officer’s target total direct compensation to the market information for executives with similar roles. The Compensation Committee’s independent compensation consultant compiles this information and size-adjusts the published survey data to reflect our asset size in relation to the survey participants to more accurately reflect the scope of responsibility for each named executive officer.

The Compensation Committee, with input from its independent compensation consultant, annually reviews and selects the peer companies, which generally consist of publicly traded, regional commercial bank holding companies. For 2019, the peer companies were selected primarily based upon the following criteria: (i) similar business operations and geographic footprint; (ii) assets and market capitalization between approximately one-half and two and one-half times our assets and market capitalization; and (iii) competitors for executive talent.

For 2019 compensation purposes, our peer group consisted of the following companies:

| Company | City, State | Total Assets at 12/31/18 (millions) | ||||

| Auburn National Bancorporation | Auburn, AL | $ | 818 | |||

| Colony Bankcorp | Fitzgerald, GA | $ | 1,252 | |||

| Community Bankers Trust | Glen Allen, VA | $ | 1,393 | |||

| Eagle Financial Services | Berryville, VA | $ | 800 | |||

| Entegra Financial Corp. | Franklin, NC | $ | 1,636 | |||

| Fauquier Bankshares | Warrenton, VA | $ | 731 | |||

| First Community | Lexington, SC | $ | 1,092 | |||

| First Community Bancshares | Bluefield, VA | $ | 2,244 | |||

| First National | Strasburg, VA | $ | 753 | |||

| HopFed Bancorp | Hopkinsville, KY | $ | 931 | |||

| Kentucky Bancshares | Paris, KY | $ | 1,086 | |||

| Limestone Bancorp, Inc. | Louisville, KY | $ | 1,070 | |||

| MVB Financial | Fairmont, WV | $ | 1,751 | |||

| National Bankshares | Blacksburg, VA | $ | 1,256 | |||

| Peoples Bancorp of North Carolina | Newton, NC | $ | 1,093 | |||

| Premier Financial Bancorp | Huntington, WV | $ | 1,690 | |||

| Reliant Bancorp, Inc. | Brentwood, TN | $ | 1,724 | |||

| Security Federal | Aiken, SC | $ | 913 | |||

| SmartFinancial | Knoxville, TN | $ | 2,274 | |||

| Southern First Bancshares | Greenville, SC | $ | 1,901 | |||

| Summit Financial Group | Moorefield, WV | $ | 2,201 | |||

| Virginia National Bankshares | Charlottesville, VA | $ | 645 | |||

| Wilson Bank Holding Company | Lebanon, TN | $ | 2,544 | |||

Elements of Compensation.The components of the 2019 executive compensation program, as well as the type of compensation and the objectives of the compensation, are discussed below:

Base Salary is established to attract and retain executives, to reward for their level of responsibility and experience, and is reviewed annually by the Compensation Committee to philosophically and practically target pay levels at the 50th percentile of our peer group.

Short-term (12 months) incentives are a variable form of compensation established annually to reward executives for the achievement of annual financial and operational goals and to promote accountability, strategic decision-making and teamwork among the executives.

Long-term incentives are a variable form of compensation granted to executive management from time to time, not every year, to align executive management with shareholder goals by linking compensation to the achievement of longer term (more than one year) strategic objectives and the increase in shareholder value. Such incentives are typically satisfied by the delivery of equity ownership in the Corporation and provide a retentive value of key executives to the Corporation.

Perquisites and Benefits are provided to our executives primarily for their health and well-being and are competitive with similar types of offerings of banks we compete with for talent. Certain benefits are provided to assist with completing their responsibilities in the roles they perform for the Corporation.

Retirement Income and Savingsare provided for all employees through our 401(k) retirement savings plan. The objectives of this element of compensation is to serve as a retention tool, to reward our employees for long-term service and loyalty, and to assist employees with saving for retirement. In 2019, we offered two NEOs a supplemental executive retirement plan to assist them with retirement income as a percentage of final base pay equivalent to that of other long-term employees due to contribution limitations of qualified plans for highly compensated key executives.

Base Salary. It is the Corporation’s philosophy that employees be paid a base salary that is competitive with the salaries paid by comparable organizations for comparable jobs based on each employee’s experience, performance and any other unique factors or qualifications. Generally, the Corporation has chosen to position cash compensation in a range around market median levels in order to remain competitive in attracting and retaining executive talent. The range is also benchmarked, and employees are paid within the market-benchmarked range based on their unique situation. Actual base salaries paid vary within a range based on performance over time. The allocation of total cash compensation between base salary and annual bonus or incentives is based on a variety of factors. In addition to the market positioning of the base salary and the mix of total compensation, the Compensation Committee also takes into consideration the following:

| · | the executive’s performance; |

| · | the performance of the Corporation; |

| · | the performance of the individual business or corporate function for which the executive is responsible; |

| · | the nature and importance of the position and role within the Corporation; |

| · | the scope of the executive’s responsibility; and |

| · | the current compensation package in place for the executive, including the executive’s current annual salary and potential awards under the Corporation’s incentive plan. |

In November of 2019, the Compensation Committee reviewed total compensation of named executive officers against market peer data in a study prepared by Pearl Meyer. Cumulative base salaries for the NEOs were determined to be within 0.5% of peer median, ranging from 94% of the median to 106% of the median.

| Named Executive Officer | 2018 Base Pay | 2019 Base Pay | Total Adjustment | |||||||||

| William L. Hedgepeth II, Chief Executive Officer | $ | 370,541 | $ | 391,363 | 5.62 | % | ||||||